Us bank equity line of credit calculator

Turn your home equity into cash with a Homeowners Line of Credit. As of July 28 2022 An early closure fee of 1 of the original line amount maximum 500 will apply if the line is paid off and closed within the first 30 months.

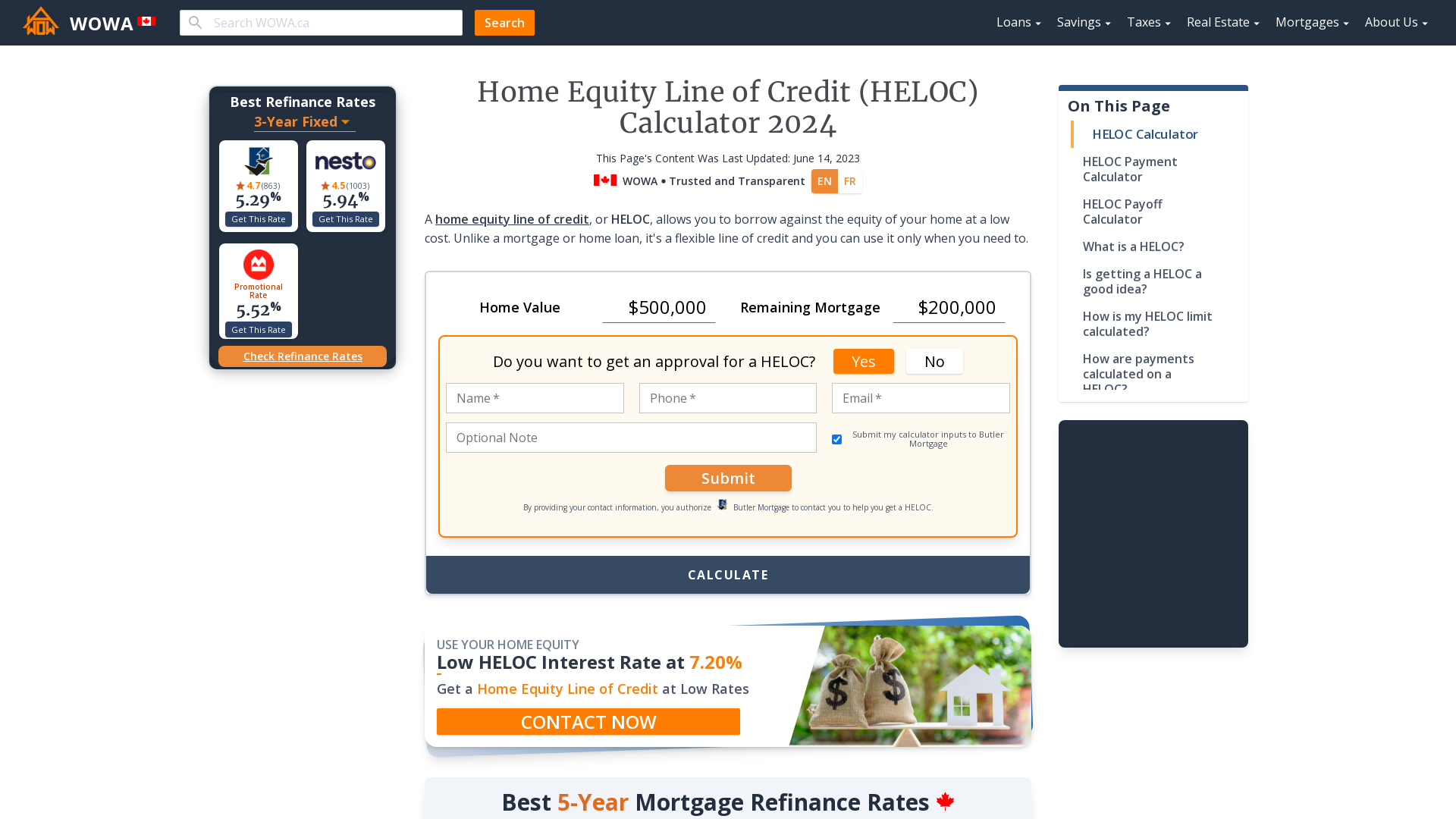

Heloc Calculator Calculate Available Home Equity Wowa Ca

This is impressive given how complicated these products can be and it shows why Chase is the largest home equity line of credit provider in the country.

. HOME EQUITY LINE OF CREDIT CALCULATOR. For lines of credit up to 500000 we will lend up to 85 of the total equity in your home for a new HELOC secured by a first or second lien. Call us today at 18669091624 or.

Put your home equity to work for you with a Home Equity Credit Line from Nevada State Bank. Our maximum loan amounts and available equity requirements vary by property type. Get a travel insurance quote.

Deposit products offered through HSBC Bank USA NA. The APR will vary with Prime Rate the index as published in the Wall Street Journal. By HSBC Bank USA NA.

Rates Requirements Calculator. A HELOC often has a lower interest rate than some other common types of loans and the interest may be tax deductible. Mortgage and home equity products are offered in the US.

HELOCs have a 10-year draw. Home Equity Line of Credit The Annual Percentage Rate APR is variable and is based upon an index plus a margin. And are only available for property located in the US.

Home Equity Line of Credit The Annual Percentage Rate APR is variable and is based upon an index plus a margin. Interest on a home equity line of credit HELOC or a home equity loan is tax deductible if you use the funds for renovations to your homethe phrase is buy build or substantially improve. Combined with their long history and branches in 41 states this makes Wells Fargo one of the best places to go if you are interested in obtaining a home equity line of credit.

Compare 0 Clear All. Using the equity youve built in your home we can provide you with a revolving line of credit to help you finance important purchases or consolidate high-interest debt. Ways to Bank.

The loan officers we worked with at Chase Bank were helpful and able to explain how each modification to their standard line of credit products would impact the structure of the product. Please send us a message by. Call travel insurance at 1-800-661-9060.

1 A new home equity line of credit application 2 A line amount of 200000 or more 3 Line must be in first lien position 4 Having a Citizens consumer checking account set up with automatic monthly payment deduction at the time of origination 5 A loan-to-value LTV of 80 or less 85 or less in Michigan and. Subject to credit approval. Try our HELOC calculator or request an instant offer today.

Getting started is quick and easy. A home equity line of credit or HELOC is a type of home equity loan that works like a credit card. HSI is an affiliate of HSBC Bank USA NA.

It can also display one additional line based on any value you wish to enter. I considered a local bank branch for a HELOC but chose to go with Prosper because of the flexible terms and the speed and simplicity. A home equity line of credit HELOC is a line of credit secured by equity you have in your home.

Whether youre funding home renovations sending a child to college or helping pay for a wedding well work alongside you to find a lending option that works best. As of July 28 2022 An early closure fee of 1 of the original line amount maximum 500 will apply if the line is paid off and closed within the first 30 months. As with most home equity lines of credit Wells Fargo will charge interest during the draw period and you only have to pay on what you borrow.

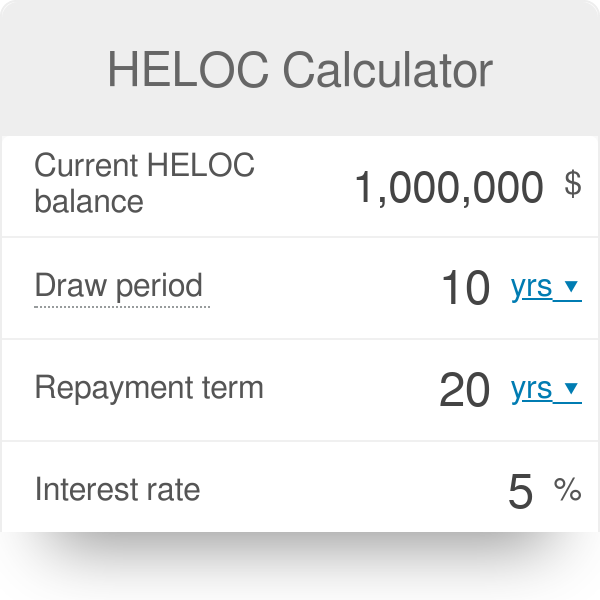

Ways to Bank. With a Home Equity Line of Credit use the equity from your home to pay for your home improvement costs. The home equity line of credit calculator automatically displays lines corresponding to ratios of 80 90 and 100.

Bank of Americas HELOC has a minimum credit line amount of 15000 in some locations but the minimum is generally 25000. Access up to 65 of your homes value to take care of extensive renovations debt consolidation and more. Obtaining the best rate also requires the following criteria to be met.

A home equity line of credit also known as a HELOC is a line of credit secured by your home that gives you a revolving credit line to use for large expenses or to consolidate higher-interest rate debt on other loans Footnote 1 such as credit cards. Programs are subject to. Is an arrangement between a bank and a customer that.

One of the nice things. For example if your lender will allow a 95 ratio the calculator can draw that line for you in addition to the other three. Youre given a line of credit thats available for a set time frame usually up to 10 years.

The maximum line amount is 1 million. Borrowers must meet program qualifications. The APR will vary with Prime Rate the index as published in the Wall Street Journal.

U S Home Equity Line Of Credit Heloc And Refinance Calculator Rbc Bank

Home Equity Line Of Credit Qualification Calculator

Home Equity Line Of Credit Heloc Rocket Mortgage

![]()

Line Of Credit Tracker For Excel

Home Equity Line Of Credit Heloc Home Loans U S Bank

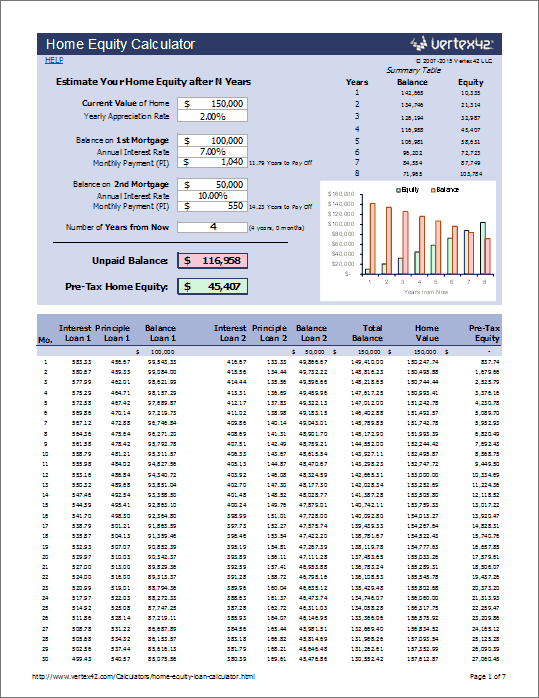

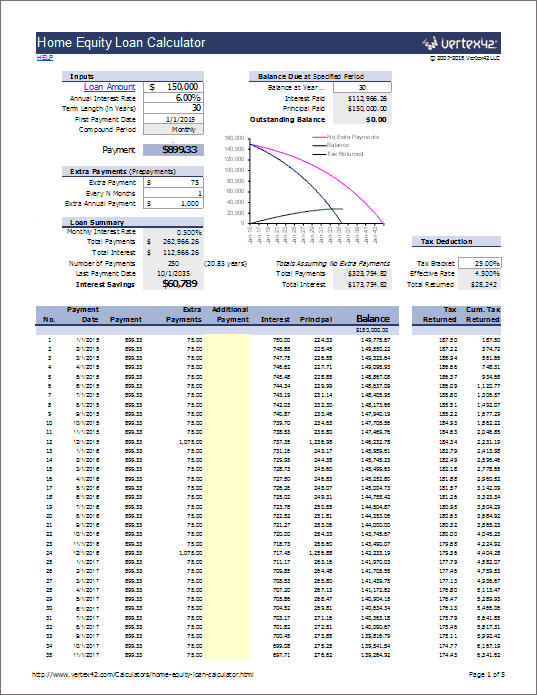

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Loans Home Loans U S Bank

How To Calculate Equity In Your Home Nextadvisor With Time

How To Use Home Equity Line Of Credit U S Bank

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Heloc Calculator

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

![]()

U S Home Equity Solutions For Canadians Rbc Bank

How To Use Home Equity Line Of Credit U S Bank

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

How To Use Home Equity Line Of Credit U S Bank